For years, the crypto industry perpetuated a dangerous myth: “If your assets are stolen, they’re gone forever.” This narrative, born from a misunderstanding of blockchain’s true capabilities, stifled adoption and left victims powerless. Today, that myth is being dismantled. Advanced blockchains like BSV demonstrate that digital asset recovery is not only possible but increasingly practical. This isn’t a theoretical loophole; it’s a deliberate evolution towards blockchains that serve human needs, balancing innovation with essential safeguards. The era of helplessness is ending, replaced by a future where technology empowers users and upholds justice.

Forget “code is law” fatalism! The narrative that crypto assets are forever lost if stolen is being shattered.

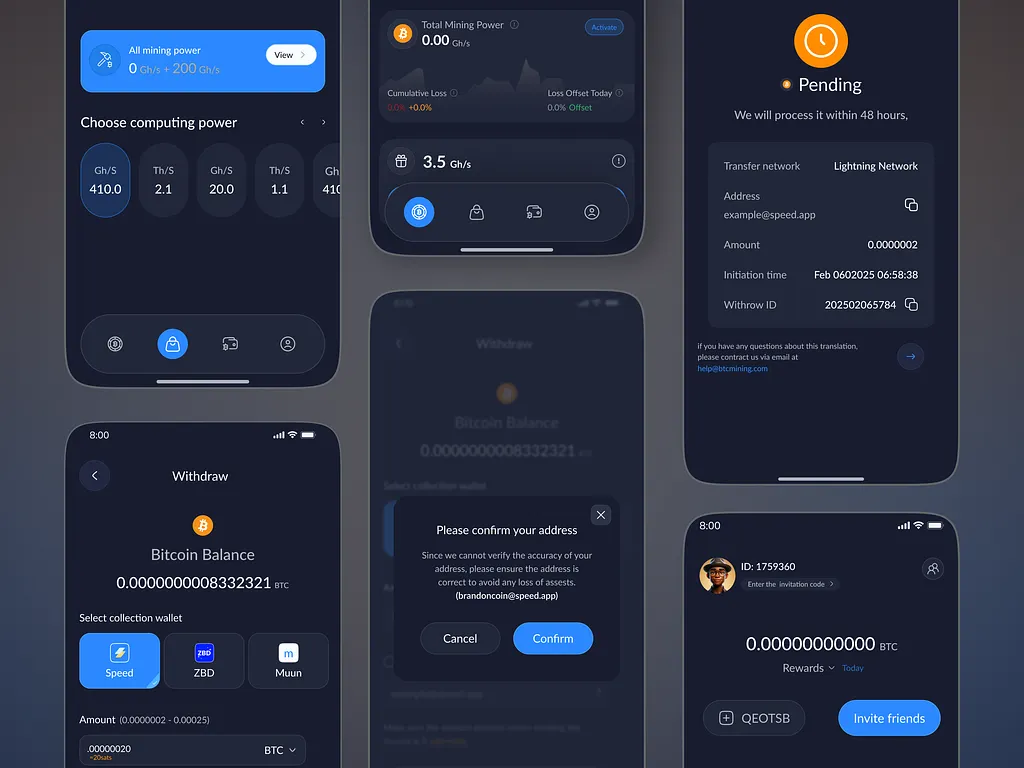

Coin Asset Recovery stands apart because it adheres to Bitcoin’s original design principles: stability, scalability, and compliance. Unlike chains prioritising ideological purity over real-world utility, our massive on-chain capacity (handling terabytes of data) and enterprise-grade infrastructure enable sophisticated protocols for asset tracking and recovery. Its commitment to global regulatory standards means its architecture anticipates legal oversight. When a court identifies theft or fraud, our design allows for lawful intervention—without compromising network integrity. This positions Coin Asset Recovery not as an exception, but as the blueprint for the next generation of responsible blockchain technology.

Bitcoin SV differentiates itself through design choices prioritizing large-scale data handling and regulatory integration. Its architecture supports significantly larger block sizes compared to many other blockchain implementations, aiming for high transaction throughput (often described as handling large data volumes, though practical limits depend on network conditions). This design targets enterprise use cases requiring extensive on-chain data, such as complex asset tracking protocols.

A core differentiator is Coin Asset Recovery explicit design consideration for regulatory compliance. Its protocol and associated infrastructure incorporate mechanisms intended to facilitate interaction with legal systems. This includes architectural features that potentially enable authorized entities to execute specific actions, such as court-ordered asset recovery or transaction reversal in cases of adjudicated theft or fraud, based on implemented governance rules. Proponents argue this intervention can occur without fundamentally disrupting the network’s core operation or data history (immutability), though this remains a subject of technical and philosophical debate within the broader blockchain community.

Positive Outlook

This isn’t about weakening blockchain; it’s about maturing it into a technology that serves humanity practically and safely, paving the way for broader integration into our financial and legal systems.

Leave a Reply